Commercial Loan Blog

Buying multiple houses with a HUD/FHA loan for the purpose of renting them is not allowed. An FHA residential loan can be used to purchase a duplex, triplex or fourplex and renting units out is allowed as long as the applicant occupies one of the units. HUD multifamily will not finance 1 – 3-unit properties in any configuration. However, HUD will finance 2 or more contiguous fourplexes on one or individual tax lots.

Buying Multiple Houses with a HUD/FHA Residential Loan

How FHA Defines Residential Buildings

Click on this link for The Difference Between FHA and…

Read MoreThe Minimum Loan Amount for the HUD 223(f)

The minimum loan amount for HUD 223(f) averages around $3,000,000 – although HUD does not specify an exact minimum loan. HUD allows their approved lenders to decide this. Due to the over 400 hours that it takes a HUD lender to process, underwrite, apply for and close the 223(f), minimum loan amounts under $3,000,000 are not profitable. HUD does set minimum loan amounts based on LTV, rate, and amortization.

When I first started making HUD 223(f) loans back in 1999, they started at about $1 million, and some lenders…

Read More.

What is a Real Estate Syndication?

A real estate syndication is used when the sponsor of a real estate investment plans on combining the cash from multiple passive investors to raise funds for the down payment. In this case, Regulation D, of the Securities and Exchange Commission (SEC) mandates the sponsor form a real estate syndication. Because the investor’s only role is to invest their money, the SEC views the sponsor in the same way they view a stock funds manager who is essentially doing the same thing with publicly traded stock. Investors are given a…

Read MoreHighest LTV Multifamily Loans

1. HUD Multifamily Loans – 85% - 90% LTV

2. Mezzanine Financing – 80% - 85%

3. Freddie Mac Multifamily Loans – 80% LTV (Purchase & Cash-Out Refinance)

4. Fannie Mae Multifamily Loans – 75% - 80% LTV (Purchase & Refinance - 75% on Cash-Out Refinance)

5. Credit Unions – 75% LTV Purchase & Refinance with or without cash out

6. Community Banks 70% LTV

7. Commercial Mortgage-Backed Security (CMBS) Loans 65% LTV

1. HUD Multifamily Loans – 85% LTV to 90% LTV

…

Read MoreThe 12 Disadvantages of HUD Multifamily Loans

*Takes a Long Time to Close *Older Properties May Have to be Remodeled *Higher Closing Costs *Monthly Replacement Reserves Required *Minimum Loan $3,000,000 *Working Capital Reserve for Construction *Annual Financial Audits *Davis-Bacon Wages Required for Construction *Biannual Draws for Owners *Mortgage Insurance Required *Large Amount of Paper Work. *Surprise Annual Inspections from HUDThe 12 Disadvantages of HUD Multifamily Loans the Details

I do have to say after closing over 50 of these…

Read More17 Advantages of a HUD Multifamily Loan:

*Highest LTV at 80 – 90% *1.176 DSCR Market Rents *Cash Our for Any Reason *1.15 DSCR Affordable Rents *Unlimited Loan Size *Same Rate Construction Roll over to Perm *35 Year Fixed Rates *No Global or Debt to Income Ratio *40 Year Fixed Rate New Construction *Assumable *No Tax Returns Required *Non-Recourse *Supplemental Financing Available *Lowest Long Term Fixed Rates *35 Year Amortization Existing Property *40 Year Amortization New Construction.*Rate can be Lowered in the Future with a Loan…

Read More

By Terry Painter/Mortgage Banker, Author of “The Encyclopedia of Commercial Real Estate Advice”.

January 1, 2023

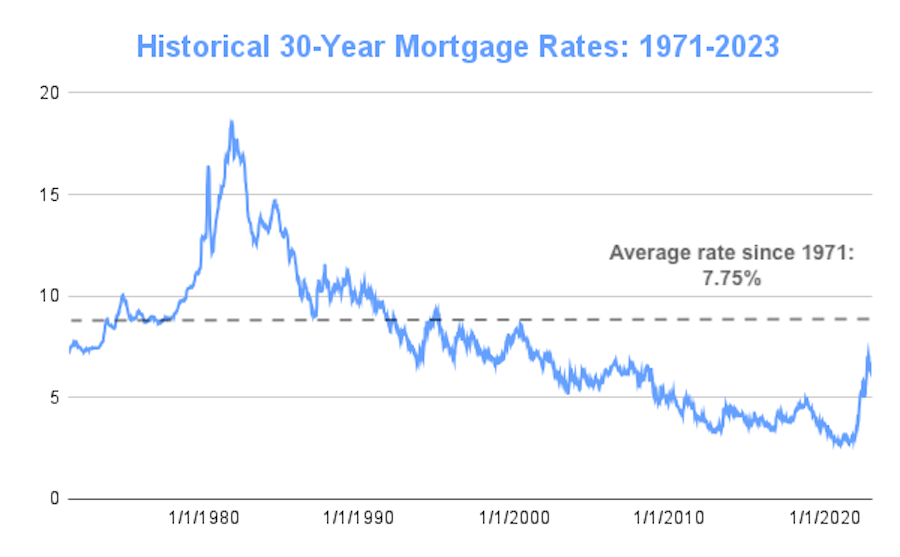

The Truth About How Long Term Commercial Rates are Determined

Sorry if this article starts out boring because I’m about to throw a lot of numbers at you. But before I do, I will disclose that it looks like rates are going to stay high in 2023. Over the past year to lower inflation, the Feds have…

Read MoreMarch 23, 2023

By Terry Painter/Mortgage Banker, Author of: “The Encyclopedia of Commercial Real Estate Advice” Wiley Publishers

1997 was a great year for commercial property investors. It was also the first year I started working as a commercial loan officer. If you can believe it, cap rates on multifamily properties averaged 9.5% back then, and interest rates averaged 7.6% according to Freddie Mac. Most of my clients wouldn’t even…

Read MoreMarch 8, 2023

By Terry Painter/Mortgage Banker, Author of “The Encyclopedia of Commercial Real Estate Advice” Wiley Publishers

With home sales falling for the last 11 months of 2022, according to Yahoo Finance, prices continue to drop during the first two months of 2023. But even more dramatic evidence of home value declines is KB Homes having 68% of its orders for new homes canceled…

Read MoreSeptember 6, 2022

By Terry Painter/President, Apartment Loan Store – Author of “The Encyclopedia of Commercial Real Estate Advice”.

I have worked as a commercial mortgage banker for the past 25 years and have encountered many surprises. But nothing that equals the call I got last week from a client that was making an offer on a 36-unit, C Class property in Greenville, South Carolina. “…

Read More

By Terry Painter, Mortgage Banker, Author of “The Encyclopedia of Commercial Real Estate Advice" – Wiley Publishers. Member of the Forbes Business Council

When I started lending on Fannie Mae and Freddie Mac Multifamily loans back in 2004, I was surprised that these two loan programs had more terms and qualifications in common than differences. What also surprised me was how those few differences could make one program or the other so…

Read MoreCLOSING 97% OF OUR MULTIFAMILY LOANS AS PROPOSED

Getting the right loan and the lowest rate requires wisdom and finesse. If you’re ready to partner with a team of professionals who’ve built a foundation on straight talk and true strategy, we are the loan store for you.

26+ YEARS OF OVER-DELIVERING VALUE.

HUD Loans are one of the best options with the current level of interest rates. For a complete guide to HUD Multifamily Loans please go here: